Sam Patterson: A Response to Senator Manchin’s Call to Ban Bitcoin

2014 Feb 27

See all posts

Sam Patterson: A Response to Senator Manchin’s Call to Ban Bitcoin @ Satoshi Nakamoto

- Author

-

Sam Patterson

- Email

-

satoshinakamotonetwork@proton.me

- Site

-

https://satoshinakamoto.network

Today, Senator Joe Manchin (D-W.Va.) asked federal regulators to ban

Bitcoin. His full remarks can be found

here. This is a response to Senator Manchin and his staff.

Dear Senator Manchin,

I'm writing in response to your recent call to prohibit the use of

the digital currency Bitcoin.

It's understandable that you would be concerned about the impacts

that this new technology would have. Since Bitcoin is so unlike existing

monetary systems, it's natural to focus on the threats it poses.

However, doing so ignores the potential benefits of a decentralized

digital currency.

How should policymakers such as yourself determine the best path to

balancing the threats and benefits of Bitcoin? The first step is for you

and your staff to learn as much as possible. I'm sure that you feel

confident you've gathered the appropriate amount of knowledge before

publicly calling for a prohibition on Bitcoin. I'm reaching out to you

in order to challenge this belief, using your own letter as evidence

that you don't yet have the knowledge of Bitcoin necessary to craft

public policy.

Inaccuracy No. 1

This virtual currency is currently unregulated and

has allowed users to participate in illicit activity, while also being

highly unstable and disruptive to our economy.

Bitcoin is not "currently unregulated."

On March 18, 2013 the Financial Crimes Enforcement Network (FinCEN)

issued guidance

explaining that "an administrator or exchanger [of virtual currency] is

an MSB under FinCEN's regulations." This regulation requires that

American Bitcoin companies register with FinCEN as a money service

business (MSB) and follow the rules laid out.

Additionally, Know Your Customer (KYC) and Anti-Money Laundering

(AML) regulations apply to these businesses as well. In fact, only in

the past few weeks has a Bitcoin ATM been launched in the United States,

lagging behind other countries because of our regulatory complexity.

Inaccuracy No. 2

Each Bitcoin is defined by a public address and a private key, thus

Bitcoin is not only a token of value but also a method for transferring

that value. It also means that Bitcoin provides a unique digital

fingerprint, which allows for anonymous and

irreversible transactions.

Bitcoin transactions aren't anonymous.

Every single Bitcoin transaction ever made is recorded in a publicly

accessibly ledger, called the blockchain. You make this point yourself

by mentioning the "digital fingerprint," it's not often that

fingerprints and anonymity are mentioned together. In fact, Bitcoin has

been referred to as "prosecution futures" by law enforcement due to its

lack of anonymity.

The assumption that digital currencies are necessarily anonymous was

explicitly rejected by testimony from

the Acting Assistant Attorney General of the Department of Justice,

Mythili Raman, at a Senate hearing last November:

To be clear, virtual currency is not necessarily synonymous with

anonymity. A convertible virtual currency with appropriate anti-money

laundering and know-your-customer controls, as required by U.S. law, can

safeguard its system from exploitation by criminals and terrorists in

the same way any other money services business could.

American Bitcoin companies already adhere to the applicable

regulations mentioned above.

Inaccuracy No. 3

Bitcoin has also become a haven for individuals to buy black market

items. Individuals are able to anonymously purchase items such as drugs

and weapons illegally. I have already written to regulators once on the

now-closed Silkroad, which operated for years in supplying drugs and

other black market items to criminals, thanks in large part to the

creation of Bitcoin.

Bitcoin is not a haven for illegal activity.

It's a shame that you were not in attendance at the Senate

hearing last year, because the law enforcement experts testifying

would have helped put your claims in context.

Edward Lowry of the Secret Service mentioned two digital currencies

in his testimony, e-gold and Liberty Reserve. Bitcoin wasn't mentioned

at all, because in his words, criminals:

...have not by and large gravitated toward peer-to-peer

cryptocurrencies...[they have] by and large gravitated toward centralized

digital currencies that are based in a locale that may have less

regulatory guidelines and less aggressive law enforcement.

Bitcoin is a peer to peer currency, not a centralized currency, thus

merited no mention from Lowry.

Unlike your letter, which contained no data or references to support

your claims, the experts at this hearing used data to put illicit

Bitcoin activity in context. FinCEN director Jennifer Shasky Calvery stated the

following:

In the case of Bitcoin, it has been publicly reported that its users

processed transactions worth approximately $8 billion over the

twelve-month period preceding October 2013; however, this measure may be

artificially high due to the extensive use of automated layering in many

Bitcoin transactions...

This relative volume of transactions becomes important when you

consider that, according to the United Nations Office on Drugs and Crime

(UNODC), the best estimate for the amount of all global criminal

proceeds available for laundering through the financial system in 2009

was $1.6 trillion.

It's clear when looking at the numbers that any illicit Bitcoin

activity is nearly immeasurable when compared to illicit usage of

traditional currencies, such as US dollars.

Also, your mention of the Silk Road doesn't work in your favor. Law

enforcement was able to take down the Silk Road, seize the Bitcoin, and

arrest many of the dealers and buyers. This is a law enforcement success

story, and doesn't show a necessity for any further restrictions.

Inaccuracy No. 4

That is why more than a handful of countries, and their banking

systems, have cautioned against the use of Bitcoin. Indeed, it has been

banned in two different countries— Thailand and

China —and South Korea stated that it will not recognize

Bitcoin as a legitimate currency.

Bitcoin is not illegal in Thailand or China.

It's true that Thailand did originally reject Bitcoin usage, but they

have recently reversed

course and are allowing it. China has restrictions in place, but it

has not been banned and several Chinese Bitcoin exchanges are functioning right now.

Aside from being inaccurate, it's unclear why you would use the

example of authoritarian foreign governments restricting their citizens'

use of digital currency as models to emulate. I trust there are no other

economy policies that you would like to replicate from these

countries.

Inaccuracy No. 5

Our foreign counterparts have already understood the wide range of

problems even with Bitcoin's legitimate uses - from

its significant price fluctuations to its deflationary

nature. Just last week, Bitcoin prices plunged after the currency's

major exchange, Mt. Gox, experienced technical issues. Two days ago,

this exchange took its website down and is no longer even

accessible. This was not a unique event; news of plummeting or

skyrocketing Bitcoin prices is almost a weekly occurrence .

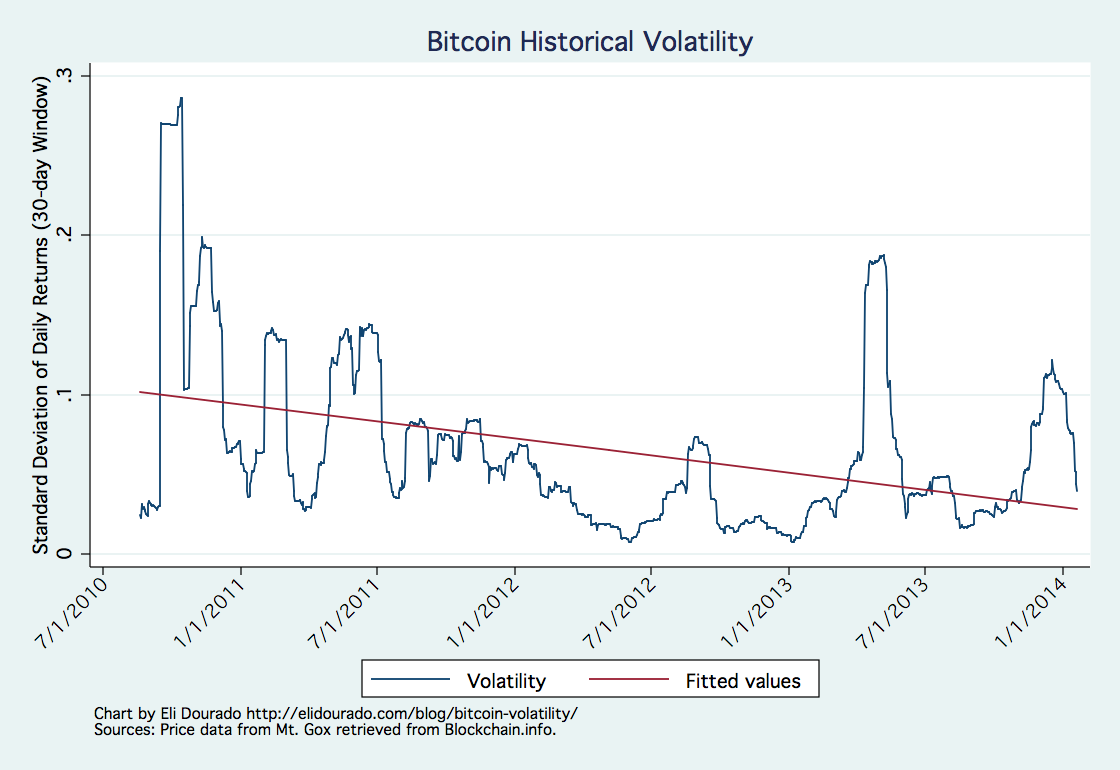

Bitcoin's volatility has been decreasing over time.

Yes, Bitcoin prices have been volatile, though considering the fixed

supply and fluctuating demand this is to be expected. However, your

comments ignore the fact that as Bitcoin grows, it becomes less

volatile, and the data supports this. Eli Dourado, research fellow at

the Mercatus Center at George Mason University, has charted

this:

Inaccuracy No. 6

In addition, its deflationary trends ensure that only speculators,

such as so-called "Bitcoin miners," will benefit from possessing the

virtual currency. There is no doubt average American consumers

stand to lose by transacting in Bitcoin . As of December 2013,

the Consumer Price Index (CPI) shows 1.3% inflation, while a recent

media report indicated Bitcoin CPI has 98% deflation. In other words,

spending Bitcoin now will cost you many orders of wealth in the future.

This flaw makes Bitcoin's value to the U.S. economy suspect, if not

outright detrimental.

The rapid increase in the number of American consumers and merchants

using Bitcoin for transactions contradicts this theoretical, and

somewhat nonsensical, objection to Bitcoin.

As an example, San Francisco company Coinbase just reached 1,000,000

consumer Bitcoin wallets and 25,000 merchants using their system.

Atlanta company Bitpay has

more than 20,000 merchants accepting Bitcoin with their system. It's

difficult to believe that so many Americans would voluntarily choose to

use a system if it were so flawed as you claim.

Indeed, the increase in the value of Bitcoin is attractive to many of

its users, and it's unclear how this harms anyone. No one is forced to

use Bitcoin, and if they prefer their currency to slowly lose its value

they can use US dollars instead.

Inaccuracy No. 7

The clear ends of Bitcoin for either transacting in illegal goods and

services or speculative gambling make me weary of its use.

"The clear ends of Bitcoin" are not for illicit uses for the vast

majority of users.

Bitcoin is digital money that was created specifically for the

internet, and it offers significant benefits over traditional

systems. It allows for fast and secure digital payments at a lower cost

than credit cards and other systems. Your letter doesn't mention any of

these benefits, nor give any evidence that the vast majority of users

aren't using the currency legally and because of those benefits.

(As an aside, I believe you meant wary, not weary.)

Conclusion

Before the U.S. gets too far behind the curve on this important

topic, I urge the regulators to work together, act quickly, and prohibit

this dangerous currency from harming hard-working Americans.

Regulators in the US have already been weighing in on Bitcoin for

months, and none of them have come to the draconian conclusion that you

have. Regulators at the state level, particularly New York state, are

looking at alternative licensing schemes, but have never even hinted at

banning Bitcoin outright. Neither have the experts who testified in

multiple hearings on the topic.

Hard-working Americans should be able to decide how they prefer to

save, spend, and manage their own money. Bitcoin gives them an

alternative to existing systems, and its rapid growth shows that many

Americans find it valuable.

I hope this letter has shown that you and your staff should take a

step back and learn more about Bitcoin before making any more policy

claims. If acted upon, your recommendations would destroy hundreds of

American tech start-ups and restrict hundreds of thousands of Americans

from handling their own money as they see fit. Policies with such

drastic impacts should only be proposed by well-informed

policymakers.

Sincerely,

Sam

Sam Patterson: A Response to Senator Manchin’s Call to Ban Bitcoin

2014 Feb 27 See all postsSam Patterson

satoshinakamotonetwork@proton.me

https://satoshinakamoto.network

Today, Senator Joe Manchin (D-W.Va.) asked federal regulators to ban Bitcoin. His full remarks can be found here. This is a response to Senator Manchin and his staff.

Dear Senator Manchin,

I'm writing in response to your recent call to prohibit the use of the digital currency Bitcoin.

It's understandable that you would be concerned about the impacts that this new technology would have. Since Bitcoin is so unlike existing monetary systems, it's natural to focus on the threats it poses. However, doing so ignores the potential benefits of a decentralized digital currency.

How should policymakers such as yourself determine the best path to balancing the threats and benefits of Bitcoin? The first step is for you and your staff to learn as much as possible. I'm sure that you feel confident you've gathered the appropriate amount of knowledge before publicly calling for a prohibition on Bitcoin. I'm reaching out to you in order to challenge this belief, using your own letter as evidence that you don't yet have the knowledge of Bitcoin necessary to craft public policy.

Inaccuracy No. 1

Bitcoin is not "currently unregulated."

On March 18, 2013 the Financial Crimes Enforcement Network (FinCEN) issued guidance explaining that "an administrator or exchanger [of virtual currency] is an MSB under FinCEN's regulations." This regulation requires that American Bitcoin companies register with FinCEN as a money service business (MSB) and follow the rules laid out.

Additionally, Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations apply to these businesses as well. In fact, only in the past few weeks has a Bitcoin ATM been launched in the United States, lagging behind other countries because of our regulatory complexity.

Inaccuracy No. 2

Bitcoin transactions aren't anonymous.

Every single Bitcoin transaction ever made is recorded in a publicly accessibly ledger, called the blockchain. You make this point yourself by mentioning the "digital fingerprint," it's not often that fingerprints and anonymity are mentioned together. In fact, Bitcoin has been referred to as "prosecution futures" by law enforcement due to its lack of anonymity.

The assumption that digital currencies are necessarily anonymous was explicitly rejected by testimony from the Acting Assistant Attorney General of the Department of Justice, Mythili Raman, at a Senate hearing last November:

American Bitcoin companies already adhere to the applicable regulations mentioned above.

Inaccuracy No. 3

Bitcoin is not a haven for illegal activity.

It's a shame that you were not in attendance at the Senate hearing last year, because the law enforcement experts testifying would have helped put your claims in context.

Edward Lowry of the Secret Service mentioned two digital currencies in his testimony, e-gold and Liberty Reserve. Bitcoin wasn't mentioned at all, because in his words, criminals:

Bitcoin is a peer to peer currency, not a centralized currency, thus merited no mention from Lowry.

Unlike your letter, which contained no data or references to support your claims, the experts at this hearing used data to put illicit Bitcoin activity in context. FinCEN director Jennifer Shasky Calvery stated the following:

This relative volume of transactions becomes important when you consider that, according to the United Nations Office on Drugs and Crime (UNODC), the best estimate for the amount of all global criminal proceeds available for laundering through the financial system in 2009 was $1.6 trillion.

It's clear when looking at the numbers that any illicit Bitcoin activity is nearly immeasurable when compared to illicit usage of traditional currencies, such as US dollars.

Also, your mention of the Silk Road doesn't work in your favor. Law enforcement was able to take down the Silk Road, seize the Bitcoin, and arrest many of the dealers and buyers. This is a law enforcement success story, and doesn't show a necessity for any further restrictions.

Inaccuracy No. 4

Bitcoin is not illegal in Thailand or China.

It's true that Thailand did originally reject Bitcoin usage, but they have recently reversed course and are allowing it. China has restrictions in place, but it has not been banned and several Chinese Bitcoin exchanges are functioning right now.

Aside from being inaccurate, it's unclear why you would use the example of authoritarian foreign governments restricting their citizens' use of digital currency as models to emulate. I trust there are no other economy policies that you would like to replicate from these countries.

Inaccuracy No. 5

Bitcoin's volatility has been decreasing over time.

Yes, Bitcoin prices have been volatile, though considering the fixed supply and fluctuating demand this is to be expected. However, your comments ignore the fact that as Bitcoin grows, it becomes less volatile, and the data supports this. Eli Dourado, research fellow at the Mercatus Center at George Mason University, has charted this:

Inaccuracy No. 6

The rapid increase in the number of American consumers and merchants using Bitcoin for transactions contradicts this theoretical, and somewhat nonsensical, objection to Bitcoin.

As an example, San Francisco company Coinbase just reached 1,000,000 consumer Bitcoin wallets and 25,000 merchants using their system. Atlanta company Bitpay has more than 20,000 merchants accepting Bitcoin with their system. It's difficult to believe that so many Americans would voluntarily choose to use a system if it were so flawed as you claim.

Indeed, the increase in the value of Bitcoin is attractive to many of its users, and it's unclear how this harms anyone. No one is forced to use Bitcoin, and if they prefer their currency to slowly lose its value they can use US dollars instead.

Inaccuracy No. 7

"The clear ends of Bitcoin" are not for illicit uses for the vast majority of users.

Bitcoin is digital money that was created specifically for the internet, and it offers significant benefits over traditional systems. It allows for fast and secure digital payments at a lower cost than credit cards and other systems. Your letter doesn't mention any of these benefits, nor give any evidence that the vast majority of users aren't using the currency legally and because of those benefits.

(As an aside, I believe you meant wary, not weary.)

Conclusion

Regulators in the US have already been weighing in on Bitcoin for months, and none of them have come to the draconian conclusion that you have. Regulators at the state level, particularly New York state, are looking at alternative licensing schemes, but have never even hinted at banning Bitcoin outright. Neither have the experts who testified in multiple hearings on the topic.

Hard-working Americans should be able to decide how they prefer to save, spend, and manage their own money. Bitcoin gives them an alternative to existing systems, and its rapid growth shows that many Americans find it valuable.

I hope this letter has shown that you and your staff should take a step back and learn more about Bitcoin before making any more policy claims. If acted upon, your recommendations would destroy hundreds of American tech start-ups and restrict hundreds of thousands of Americans from handling their own money as they see fit. Policies with such drastic impacts should only be proposed by well-informed policymakers.

Sincerely,

Sam